When you buy a product from a non-EU country then effectively you become an importer and become liable to Customs and Excise Duty as well as Value Added Tax (VAT) payments. If the terms of sale do not specify another arrangement, the goods would normally be held by the Customs Authority at entry, pending the payment of duty and tax. Customs officers examine packages arriving from outside the EU in order to:

- Check for prohibited or restricted goods,

- Confirm that the description and value stated on the Customs Declaration is correct and

- Check the Customs Declaration to determine if Customs Duty, Excise Duty and/or Import VAT are chargeable.

New Customs and VAT e-commerce Parcel Regulations as from 1 July 2021

A number of amendments to EU Directive 2006/112/EC will come into force on 1 July 2021 and shall affect the Customs and VAT rules applicable to cross-border business-to-consumer (B2C) e-commerce activities. In a nutshell, Customs controls and VAT will apply when purchasing goods from non-EU countries, even for items under €22 which are currently exempted from VAT. If the VAT is pre-paid to the seller, there are no extra charges when the item arrives in Malta.

VAT

The import VAT is calculated as a percentage (VAT rate) of the taxable amount.

- The VAT rate is the one applicable in the country (i.e. Malta) where the goods are being delivered.

- The taxable amount is made up of the customs value + the duty paid and the transportation and insurance costs up to the first place of destination within the EU.

VAT is not due when the total value of all goods in a consignment (value not inclusive of customs duties or transport costs) is less than a threshold. This exception does not apply to tobacco or tobacco products and alcoholic products.

The import VAT may either be included into the overall delivery price or not.

- If the import VAT is not included in the price paid to the seller (which is the common situation), you will have to pay it to the postal company or express courier.

- If you pay all inclusive, you will be paying import VAT to the seller when paying the total price. But if the import VAT is not properly estimated by the seller, or if the seller fails to ensure the transfer of this VAT amount to the customs, you must be aware that national legislation can hold you jointly liable.

Customs duty

On the basis of the data provided in the customs declaration, the supporting documents that accompany it and any information which they may request, the competent customs officers determine, impose and collect Customs duties that are due.

Customs duty is calculated as a percentage of the customs value of the goods:

- The percentage or rate varies depending on the type of goods. You can check the tariff applicable in the TARIC database.

- The customs value is made up of the price paid for the goods, the insurance cost and the shipping cost.

- In some cases additional duties may be charged, depending on the country of manufacture of the goods. The TARIC database coves all measures relating to tariff, commercial and agricultural legislation.

Customs Duty is not due for goods, provided directly to the buyer when their value does not exceed 150 Euros. This exception does not apply to perfumes and toilet waters, tobacco or tobacco products and alcoholic products which are subject to special limits on the quantity provided. VAT, Customs and Excise duties are likely to be paid on top of the advertised purchase price.

Please check delivery details with your seller as some commercial websites may offer to show a value on the Customs Declaration that is much lower than the actual price paid so that you don't have to pay duty and/or VAT which may result in seizure of the goods.

Excise duty

The goods will be held by the Malta Customs Authority at entry into your country, pending the payment of excise duty. The Rates of excise duty are set by each individual Member State. Cigarettes and hand-rolling tobacco must bear health warnings and fiscal marks, and containers of spirits that are larger than 35cl must bear a duty stamp.

Customs Processing Fees

MaltaPost provides services to simplify the clearance through Malta Customs of your items in order to speed up the delivery process.

MaltaPost, as the designated Universal Postal Service Operator is authorised to carry out customs clearance on behalf of its customers. The delivery of these services entitles MaltaPost to levy a fee based on the total cost of the operation which involves the collecting of the required documentation, presenting the same documentation to the Customs Authorities, clearing dutiable goods on your behalf and subsequently effecting payment of the Customs Dues and VAT in order for your item to be released from Malta Customs.

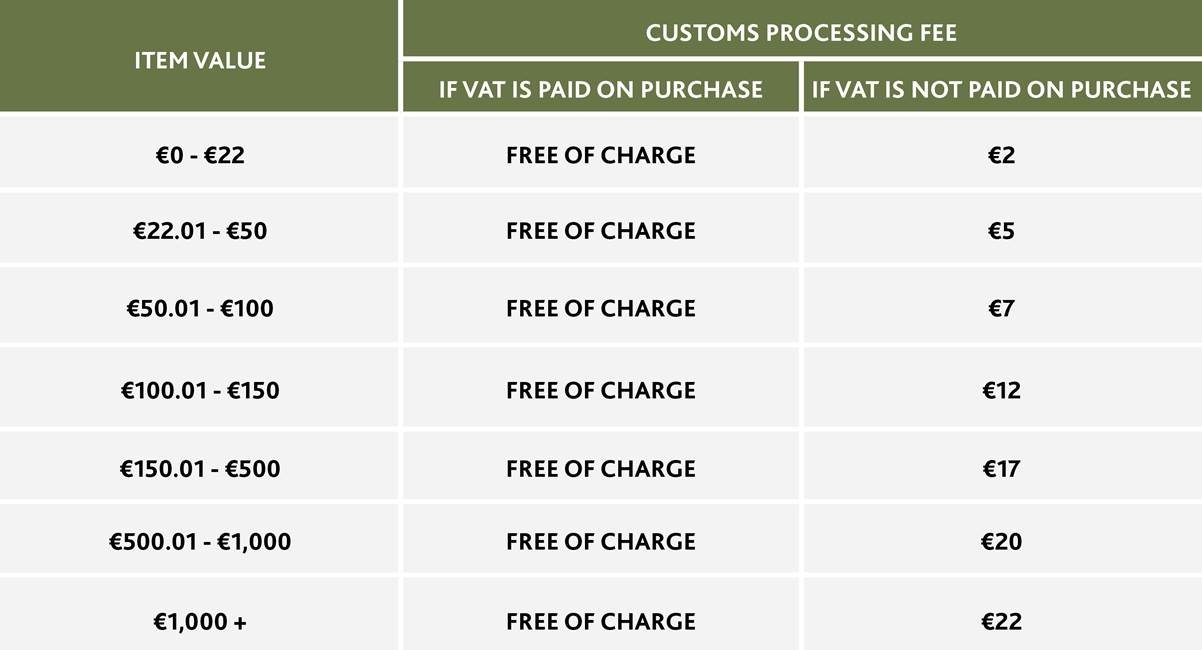

Postal items subject to customs control will be charged a Customs Processing Fee, the amount of which is fixed as per table below.

Undertaking the Customs Clearance Process Yourself

Should you decide to undertake the Customs Clearance Process yourself or should you decide to appoint your own Customs Agent to handle the same Customs Clearance Process on your behalf, you are to inform us of such a request on e-mail: info@maltapost.com. Please do not forget to include your parcel tracking number.

Further details on how you may undertake the Customs Clearance Process yourself and what is required to be able to do so are found on the Malta Customs website https://customs.gov.mt and https://customs.gov.mt/electronic-systems/faqs/completing-customs-declarations.

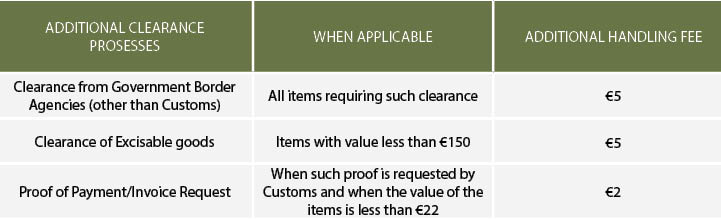

Additional Handling Fees

Submit your Customs Declaration Online

We have now simplified the process for all our customers by introducing a new facility to declare items purchased from outside the EU online. To submit a declaration, you just need to follow the below simple steps:

- Visit www.maltapost.com/tracking, enter the tracking number in the space provided and click the 'Declare Items Button'

- Insert and confirm your email address

- Go to your inbox, find an email with the link that will prompt you to the Declaration page

- Complete the details and upload the requested documentation

The process is explained in this Tutorial Video.

Pay Customs Clearance Charges Online

To pay online you just need to visit www.maltapost.com/tracking and enter the tracking number in the space provided. Please wait for the parcel details to be loaded, click on the Pay Charges button and proceed as instructed.

The process is explained in this Tutorial Video.